The invoice due date is the date mentioned in the invoice, instructing the clients to make the payments on the specific date.

Story

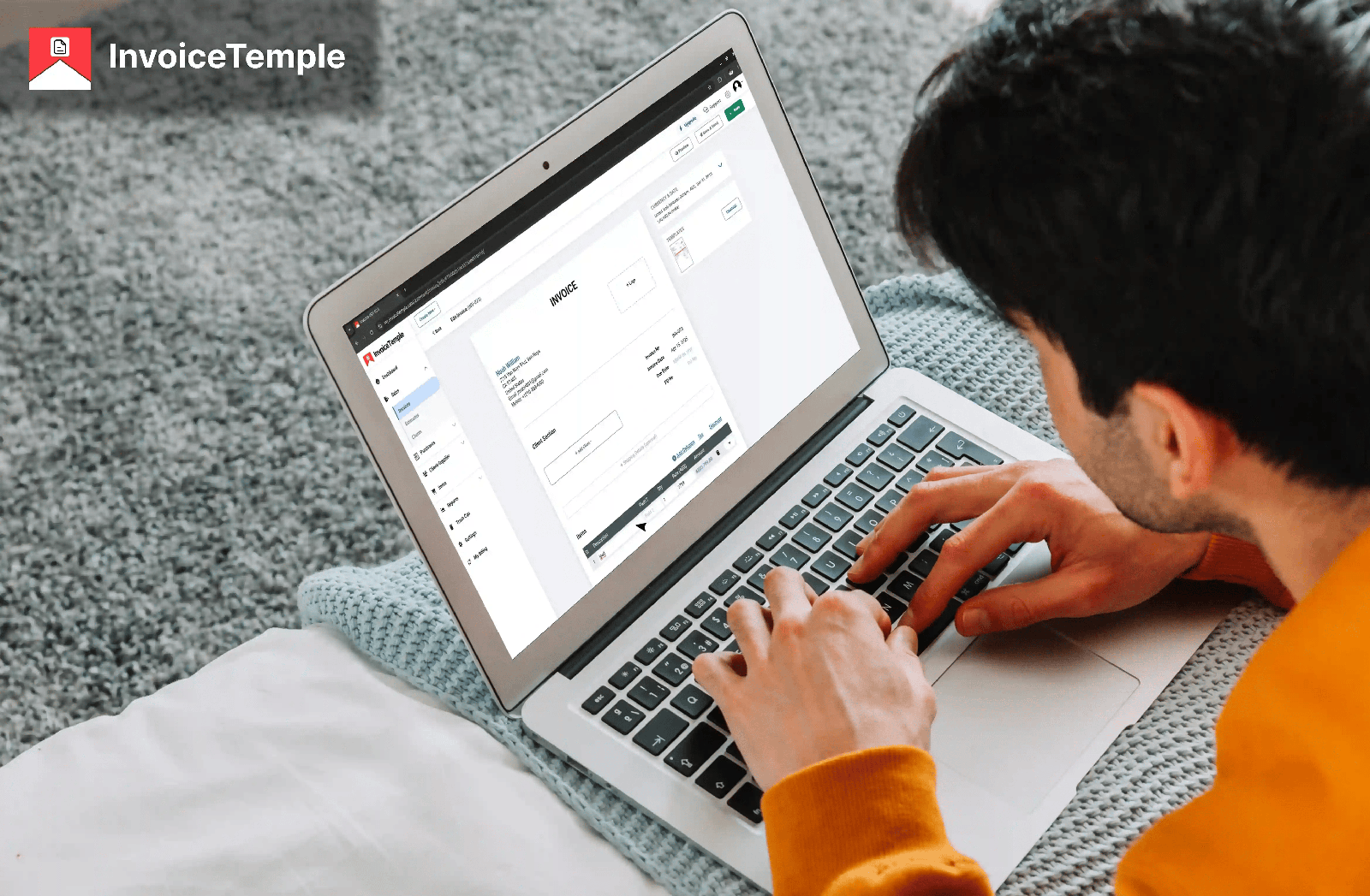

Understanding Invoice Due Dates and How to Set Them Properly

chapters

The invoice due date is the date mentioned in the invoice, instructing the clients to make the payments on the specific date.

The purchase orders are initial documents for the business, indicating the list of items to be purchased. Mastering them is crucial for success.

Business success lies in implementing some effective tips, like perfect planning, maintenance of business records, being focused, etc.

Facing the situation of losing clients creates a drop in energy and work. But if it is handled effectively, then the business will be a success.

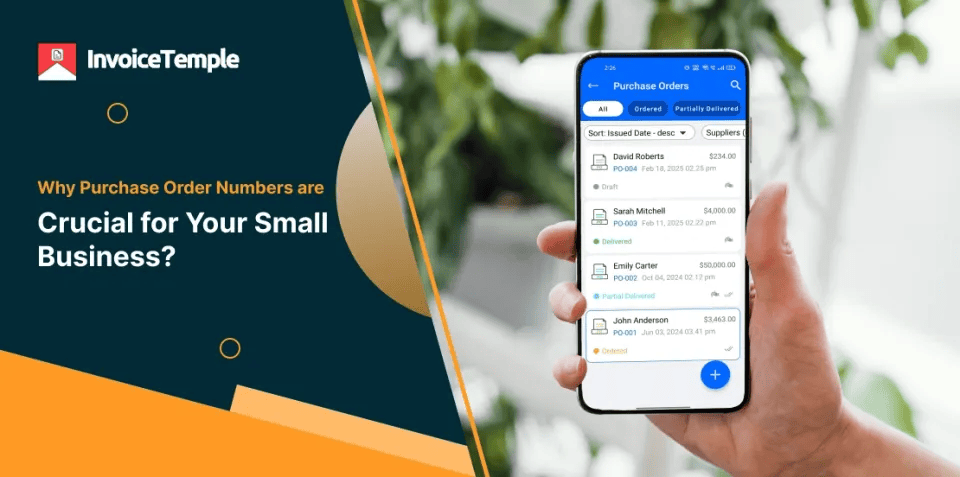

Purchase order numbers are essential for tracking, inventory, and auditing. Avoid errors with InvoiceTemple’s automated system.

Maximizing and Calculating Billable Hours for Business Success

Inventory valuation impacts profitability. Methods like FIFO, LIFO, and WAC guide income and cash flow, while tools like InvoiceTemple aid decision-making and growth.

Explore the role of InvoiceTemple in boosting business efficiency with its automated invoicing features. Use it to streamline the workflow.

Explore how corporate tax calculator tools provide accurate calculations, reduce errors, and save your time.

Contracts are for long-term agreements, while Purchase Orders (POs) are for short-term transactions. Tools like InvoiceTemple help manage both efficiently.

Automated supplier invoices streamline workflow, cut costs, and improve accuracy with InvoiceTemple’s smart invoicing solutions.

Explore the different types of cost accounting methods for small businesses and perfectly manage your accounts using InvoiceTemple.

Vouchers and invoices have key differences and roles in business transactions. Generate them easily and professionally with InvoiceTemple.

Advance payments boost cash flow and guarantee commitment, but may involve risks like cancellations or tax issues. Using clear invoices and tools like InvoiceTemple can simplify management and ensure smooth transactions.

Legal billing software automates invoicing, payments, and case management, reducing errors, centralizing data, and boosting law firm productivity.

Learn how free online income tax calculators help businesses save time. Discover top benefits and simplify your invoicing process today.

Understand Net 45 payment terms, calculate due dates, and manage cash flow efficiently with InvoiceTemple’s easy invoicing solutions.

Explore the factors for high invoice processing costs. Learn how InvoiceTemple reduces invoicing costs and improves business efficiency.

Achieve financial freedom as a freelancer with smart budgeting, expense tracking, marketing, invoicing, and tax management tips.

Learn key revenue recognition methods and benefits for small businesses. Simplify tracking with InvoiceTemple for better financial stability.

Write a comment ...